Lenders in the Loanable Funds Market Consist of

10132021 Create an account. The loanable funds market is illustrated in Figure.

Reading Loanable Funds Microeconomics

In the figure at an interest rate of 4.

. These consist of household savings and or bank loans. Demand for loanable funds is determined by the willingness of firms to borrow funds to engage in new investment projects. This term you will probably often find in macroeconomics books.

Households and foreign entities c households and foreign entities. Mutual fund firms stock exchanges and banks. Explore the definition and theory of loanable funds and learn about the market prices for loanable funds and how its affected by the rule of supply and demand.

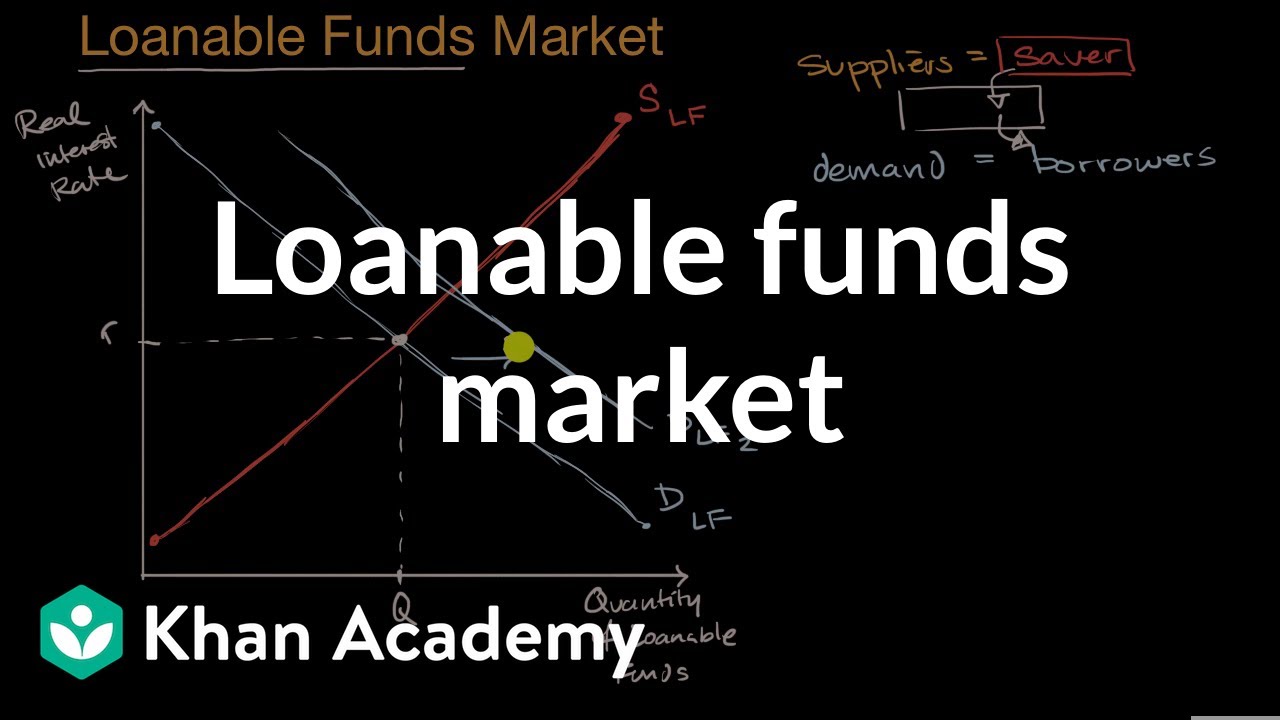

Transactions involve money not goods or services. The Loanable Funds Market The loanable funds market is made up of borrowers who demand funds D lf and lenders who supply funds S lf. View the full answer.

Loanable funds market is a market where the demand and supply of loanable funds interact in an economy. The demand for loanable funds is greater than the supply of loanable funds. Demand for loanable funds is determined by the willingness of firms to borrow funds to engage in new investment projects.

Borrowers in the loanable funds market consist of a. The demand for loanable funds is based on borrowing. The Market for Loanable Funds.

It might already have the funds on hand. We made the simplifying assumption that the financial system consists of only one market called the market for loanable funds. The demand and supply of capital is also related to the demand and supply of loanable funds.

Loanable funds are funds that are available for borrowing. In the market for loanable funds graph and explain the effect of the. Did lebron play against shaq.

The demand and supply of capital is also related to the demand and supply of loanable funds. The quantity demanded of loanable funds is greater than the quantity supplied of loanable funds and there is a surplus of loanable funds. All lenders and borrowers of loanable funds are participants in the loanable funds market.

The loanable funds market determines the real interest rate the price of loans as shown in Figure 4-51. Savers are the suppliers of loanab. Factors that cause shifts in the loanable funds demand curve includeschanges in perceived business opportunitiesgovernment borrowings etc.

The rate of interest is price paid for using someone elses money for a specified time period. The demand curve for loanable funds is downward. All savers go to this market to deposit their saving and all borrowers go to this market to get their loans.

The supply of loanable funds is based on savings. Ad Earn 150 When You Apply Get Approved Verify Your Bank Account. In economics the loanable funds doctrine is a theory of the market interest rate.

The Supply of loanable funds consists of lenders willing to lend their money to borrowers in exchange for a price paid on their money. According to Dennis Roberston and neo-classical economists this price or the rate of interest is determined by the demand for and supply of loanable funds. According to this approach the interest rate is determined by the demand for and supply of loanable funds.

Basically this market is a domestic financial market. Question 1 Lenders in the loanable funds market consist of O foreign governments the domestic government and households. Domestic entities and firms Ob firms and the US.

Introduction to the Loanable Funds Theory. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out. The quantity demanded of loanable funds equals the quantity supplied of loanable funds and equilibrium is reached.

Economics questions and answers. It can also raise funds by selling shares of stock as we discussed in a previous module. This means that higher interest rates are going to motivate people to either start.

Smni debate panelist names bulls stats today near frankfurt loanable funds market. In this market there is one interest rate which is both the return. O households individuals and foreign entities.

To understand the market for. In this market there is one interest rate which is both the return to saving and the cost of borrowing. The total amount of funds supplied by lenders makes up the supply of loanable funds while the total amount of funds demanded by borrowers makes up the demand for loanable funds.

The market for loanable funds consists of. Figure 4-51 Market for Loanable Funds QUANTITY OF LOANABLE FUNDS REAL INTEREST RATE Q lf D lf S lf i. Question 10 2 points According to the textbook savers in the loanable funds market tend to be and borrowers tend to be a the government and foreign entities.

All savers go to this market to deposit their saving and all borrowers go to this market to get their loans. The market for loanable funds consists of two actors those loaning the money savings from households like us and those borrowing the money firms who seek to invest the money. The term loanable funds includes all forms of credit such as loans bonds or savings deposits.

Banks foreign governments and bonds. Lenders represented by the supply curve in the loanable funds model include direct lenders such as banks mortgage companies credit card companies and auto and equipment leasing companies a lease used instead of debt such as an auto. The market for loanable funds describes how that borrowing happens.

Firms and governments arbitrage companies banks and firms. Households and foreign entitiesearbitrage companies banks and firms. When we first analyzed the role of the financial system in Chapter 25 we made the simplifying assumption that the financial system consists of only one market called the market for loanable funds.

O mutual fund firms stock exchanges and banks. The loanable funds supply comes from households. Business Funding When You Need It.

When a firm decides to expand its capital stock it can finance its purchase of capital in several ways. Those loaning the money are the suppliers of loanable funds and would like to see a higher return on their savings. When a firm sells stock it is selling shares of ownership of the firm.

These consist of household savings andor bank loans.

Reading Loanable Funds Microeconomics

The Market For Loanable Funds Ifioque

0 Response to "Lenders in the Loanable Funds Market Consist of"

Post a Comment